There are thousands of analytics, email, and marketing tools out there waiting for you to try them.

It’s no secret, choosing between these thousands of tools is complex. It’s hard to assess which tools you’ll outgrow in the next two months versus the ones which will grow with you for years.

At Segment, we’ve now seen thousands of companies embark on this journey. From their earliest stages to reaching unicorn status, we’ve watched companies switch out their data stacks hundreds of thousands of times.

We’d like to help you plan ahead. In this post we’ll share the trends we’ve seen over the last three years when it comes to switching tools. It’s our hope that this analysis gives you a window into what’s next and how to think about evaluating different vendors for your data stack. (You can also talk to a Segment team member if you want some pointers for building your stack)

The dataset and adoption graphs

In this article, we’ll dig into a Segment dataset that goes all the way back to mid-2016. It looks at all of our accounts, and includes day-by-day results for which destinations each workspace has enabled (quick caveat, it does not include sources or warehouse destinations).

We’ve chosen to graph this data with time as the x-axis. On the y-axis, we graph a line for each tool. The colors also indicate a rough categorization. Similar colors correspond to similar categories of tools.

Without further ado, let’s dig in to the different ‘archetypes’ we’ve observed. They’re ordered from most to least common:

-

The Bake-off

-

The Graduation

-

The Bulk Buy

-

The Switch

-

The Evolution

-

The “Marie Kondo”

-

The GDPR Worrier

-

The Scientist

-

The Early Adopter

-

The New Hire

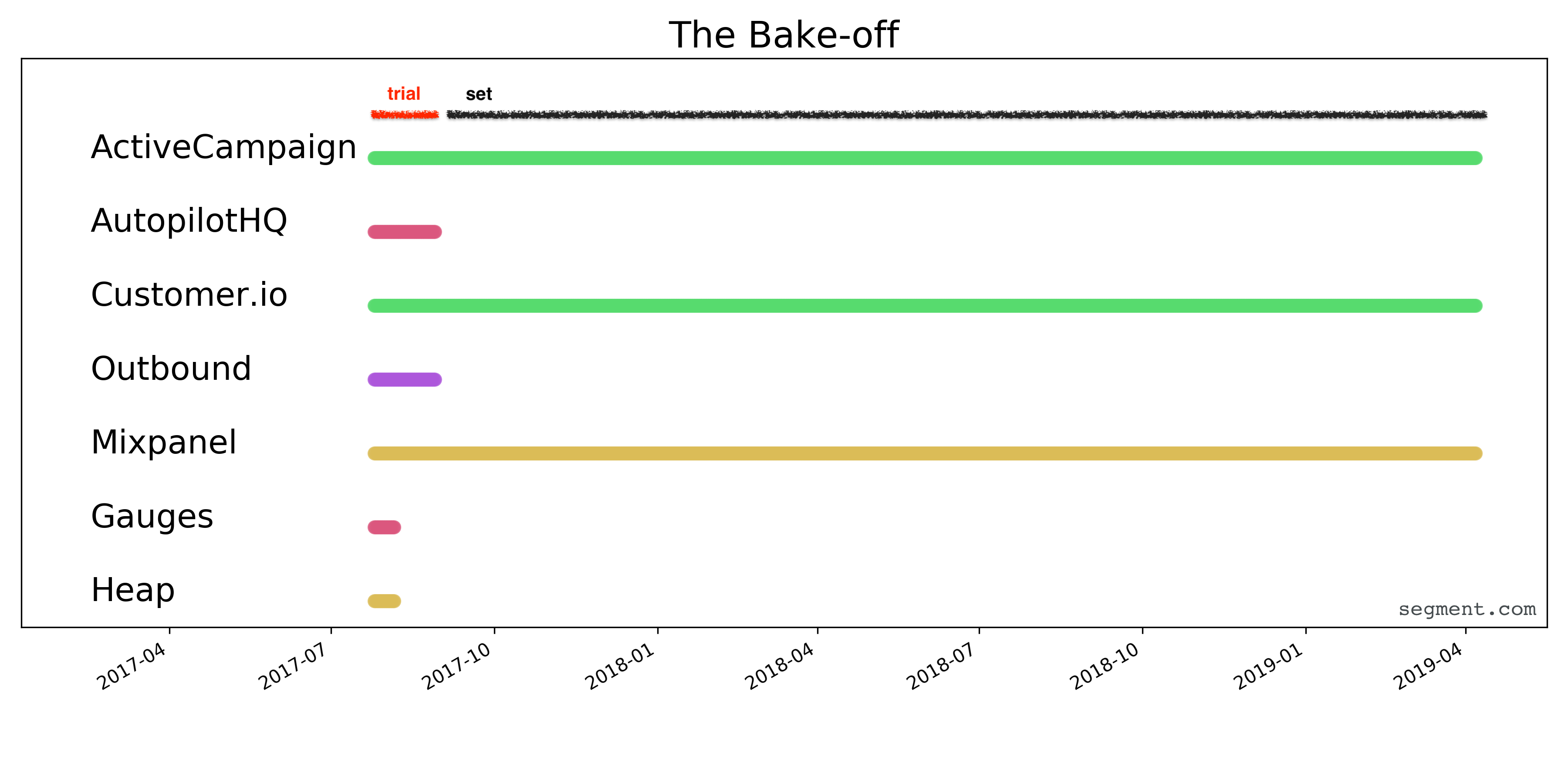

1. The Bake-off

What it is: The first trend we see is companies that use Segment to send the same data to a bunch of tools all at once. It’s sort of like ordering multiple pairs of sneakers, and returning everything but the ones you like.

What it looks like:

Here you can see a user who initially started with six different tools (including a few which compete against one another). After two months of trialing, they picked the long-term tools they wanted to keep (ActiveCampaign, Customer.io, Mixpanel), and ditched the rest.

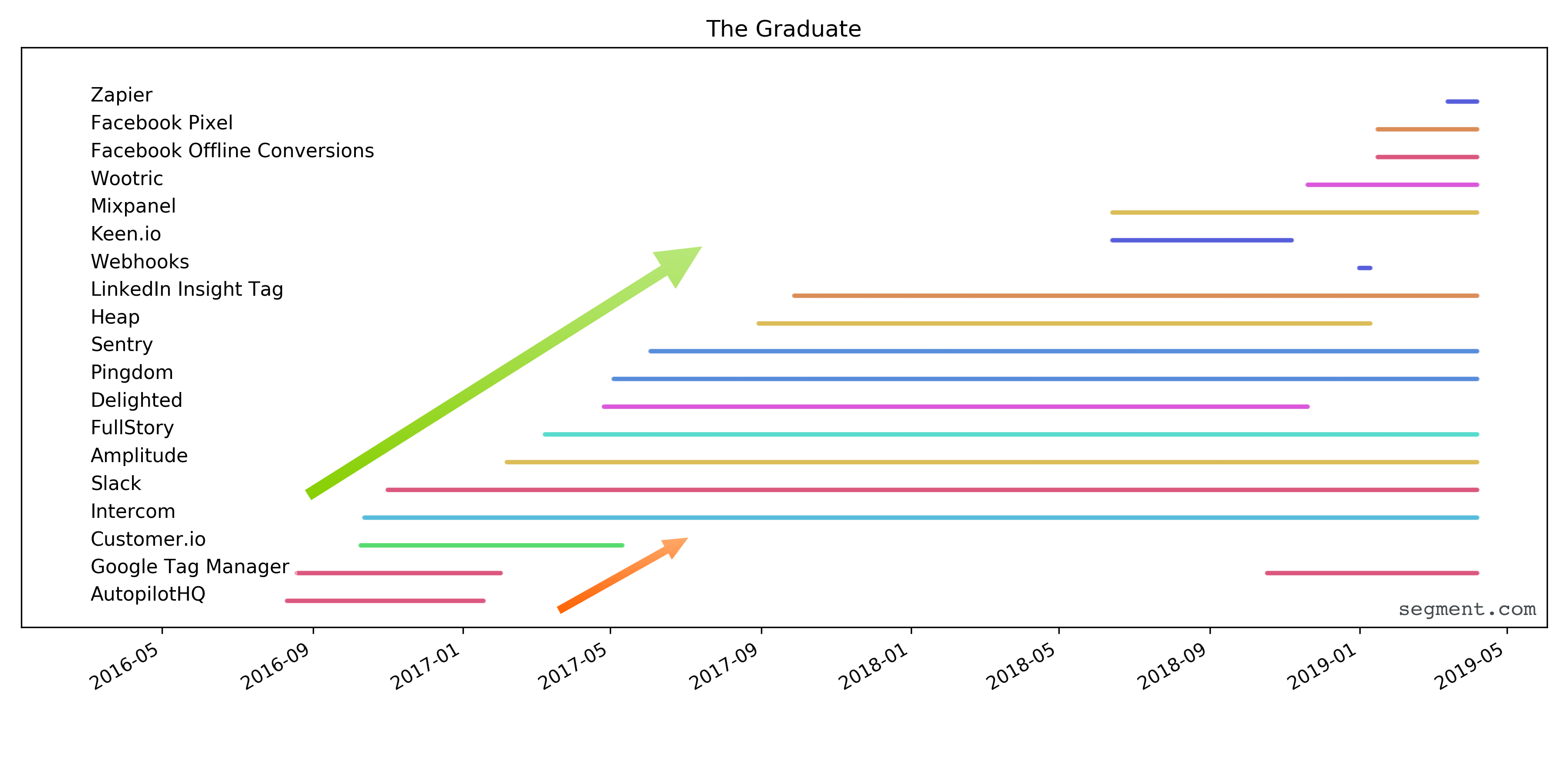

2. The Graduation

What it is: While other companies compare tools all at once, these companies have a steady ‘graduation’ across tools—they start with a handful of use cases, and steadily shift those out over time.

What it looks like: Graphs like these tend to look like a rhombus going up and to the right. As new tools come on the market, the old ones are replaced by newer, better fits.

These users add a few tools every month. As they discover new parts of their business to unlock, and new best-in-breed tools, they migrate their business to use the cutting edge.

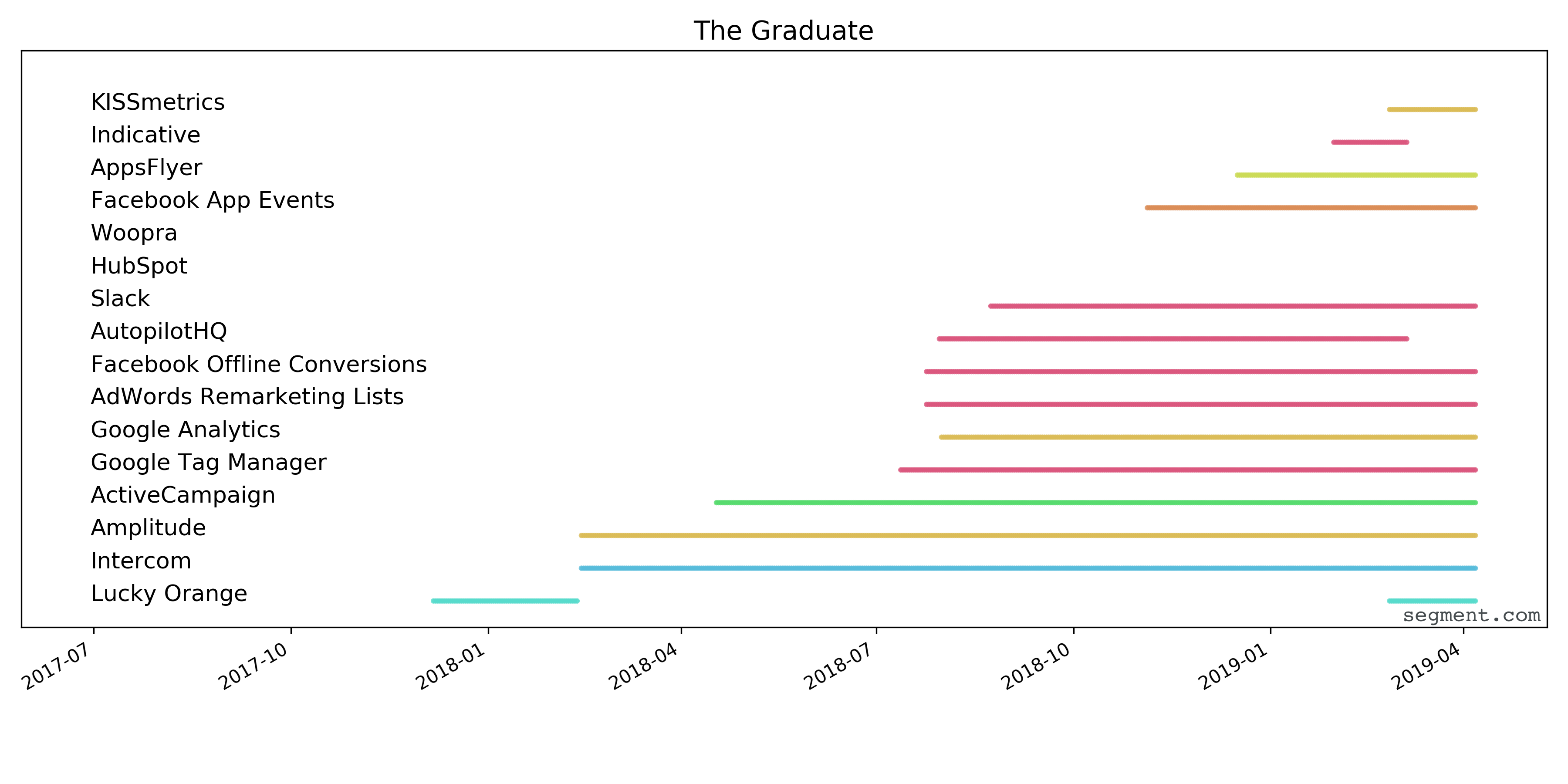

We see some graduates fall more in the camp of continuing to add tools as they fit new use cases.

In this case, the user started with just a single tool, but steadily expanded over time. Over a 1.5 year period, they moved from a single use case of Lucky Orange to over 12 different tools spread across analytics, messaging, advertising, and attribution use cases.

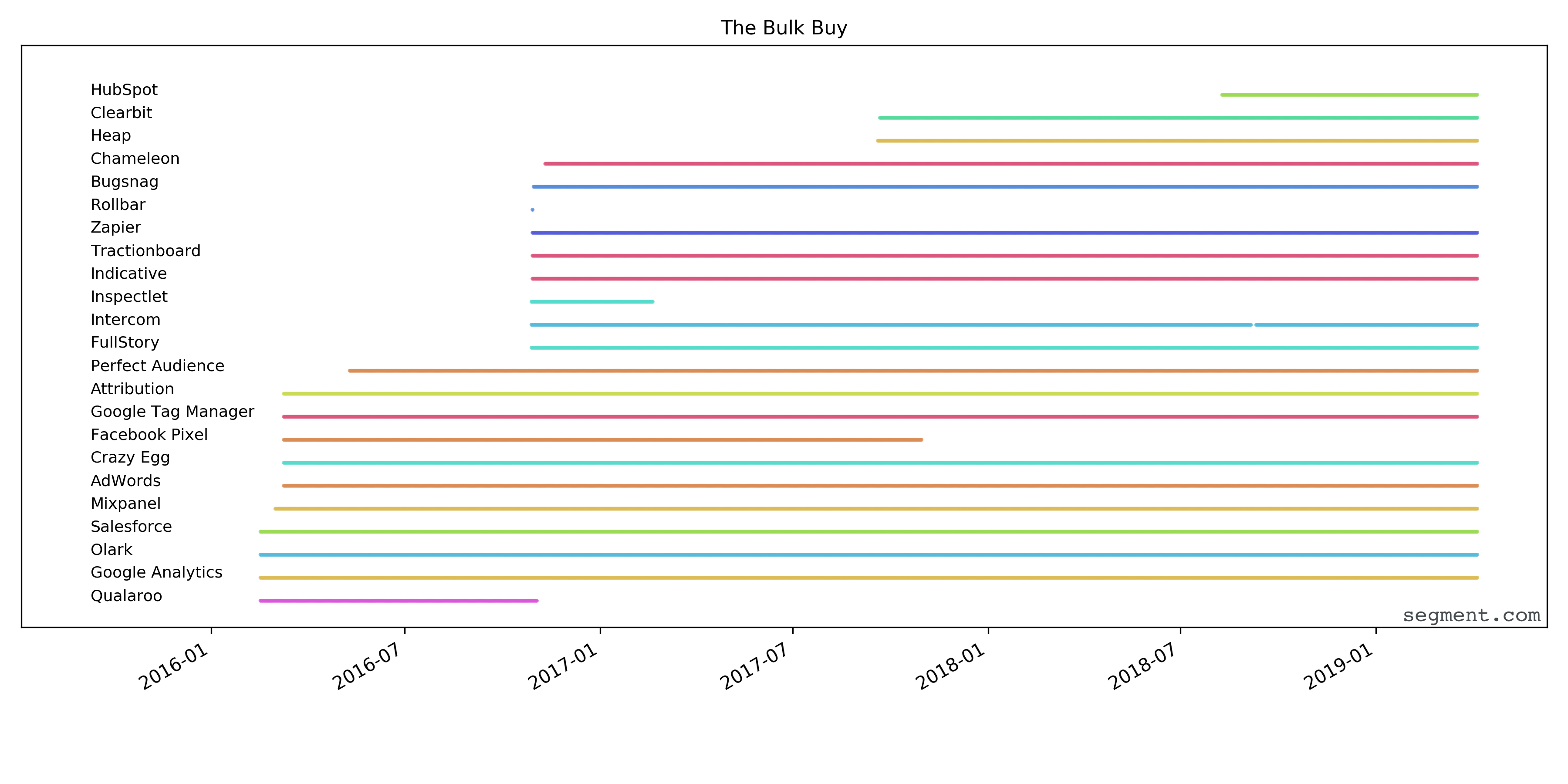

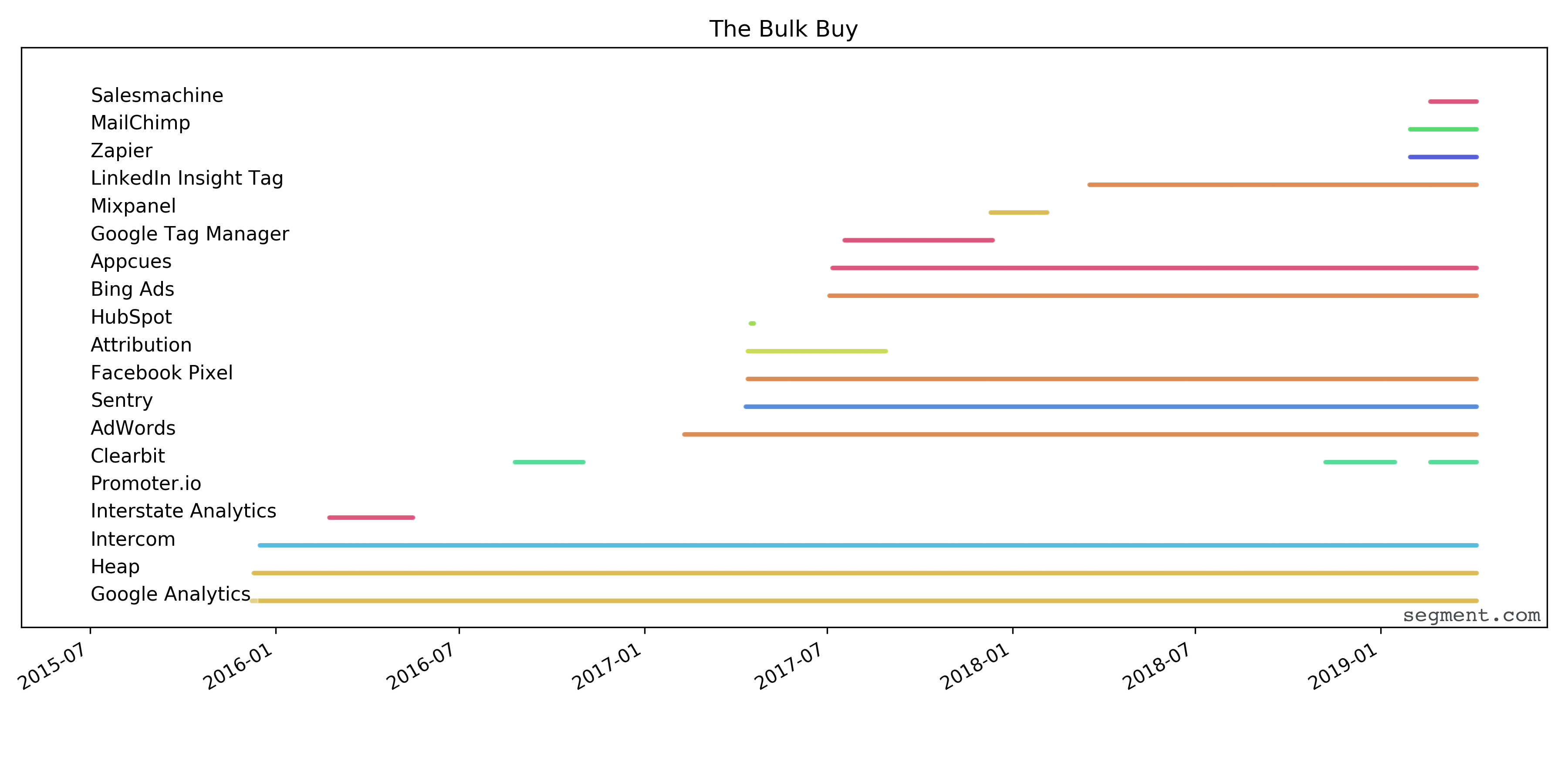

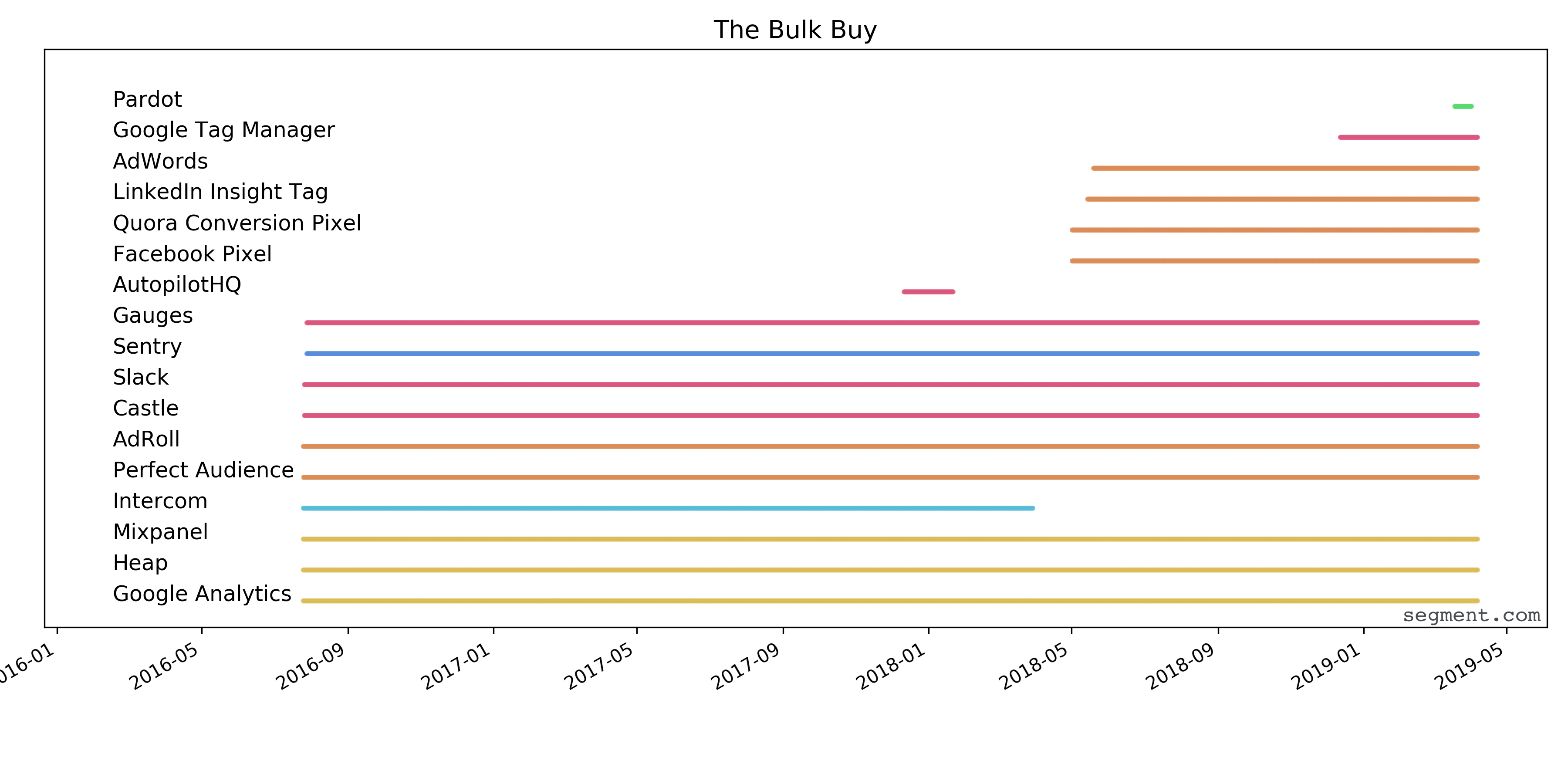

3. The Bulk Buy

What it is: To our surprise, not all users take the slow and steady path of the graduates. Sometimes we also see them make big stack decisions in bulk. Users don’t just enable tools one at a time. They often enable new destinations in groups of 3 to 5. Unlike the ‘bake-off’, we see users enabling tools across categories.

What it looks like:

In the above graph, you can see three of these distinct refreshes happen: March 2016, November 2016, and September 2017. In each case, the number of tools the customer was using expanded significantly, with a handful of tools being shut off.

Below, you can see examples of other bulk buys.

In each case, the use cases for each of these tools are different (they are color-coded by category). But their timing lines up consistently.

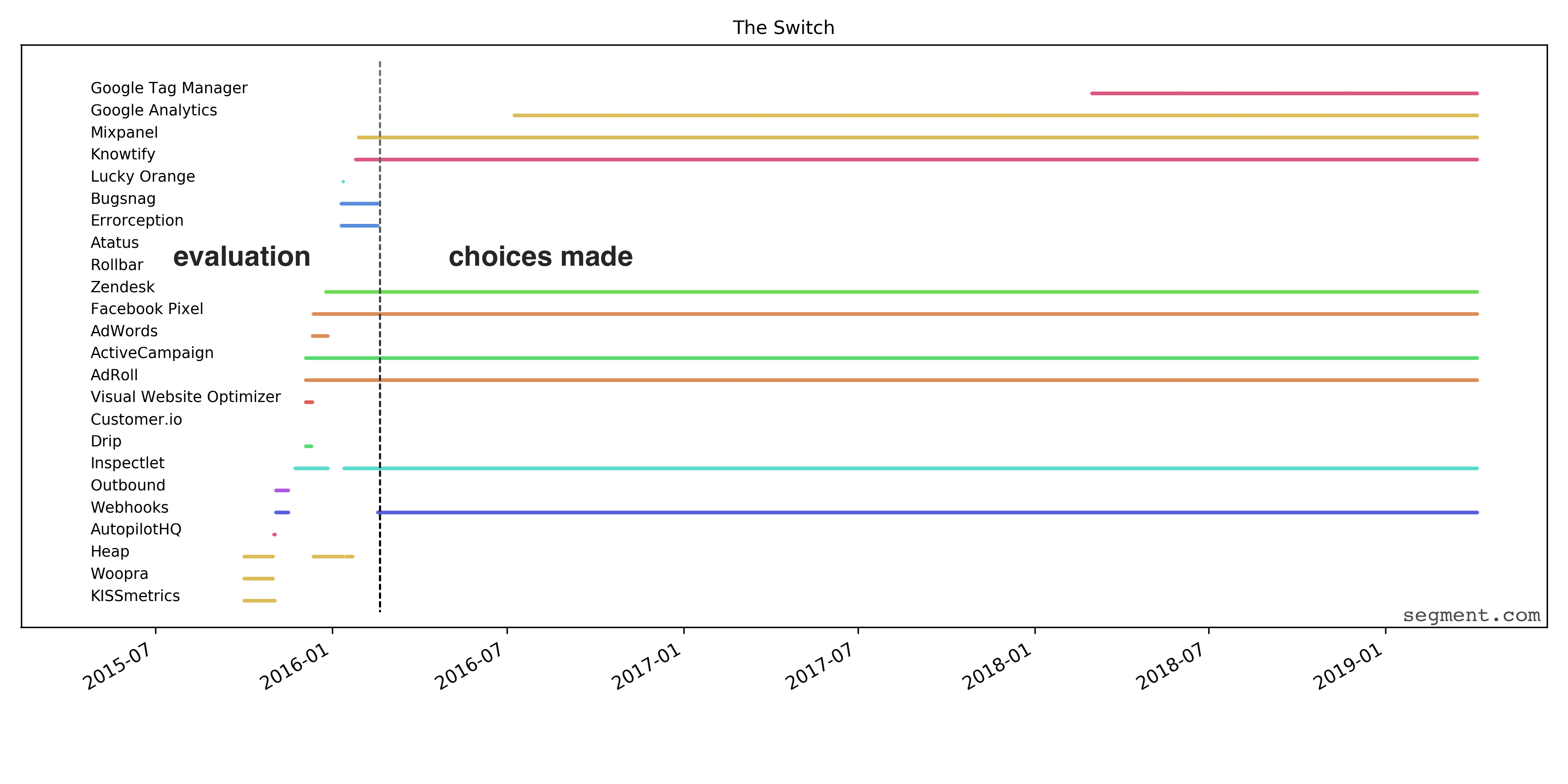

4. The Switch

What it is: They don’t slowly graduate and they don’t make bulk decisions, these companies switch tools in quick succession when they first begin using Segment. Then, they settle into more of a routine set of tools which are only altered every 6 months.

What it looks like:

This user had an initial 5-month period where they enabled 22 different destinations. They ended up sticking with just 10 of those for the long run after some initial experimentation.

You can also see by the grouping of like colors that this user was running a bit of a ‘bake-off’ as well. They start by trying three analytics tools, then move on to the advertising and error tracking use cases.

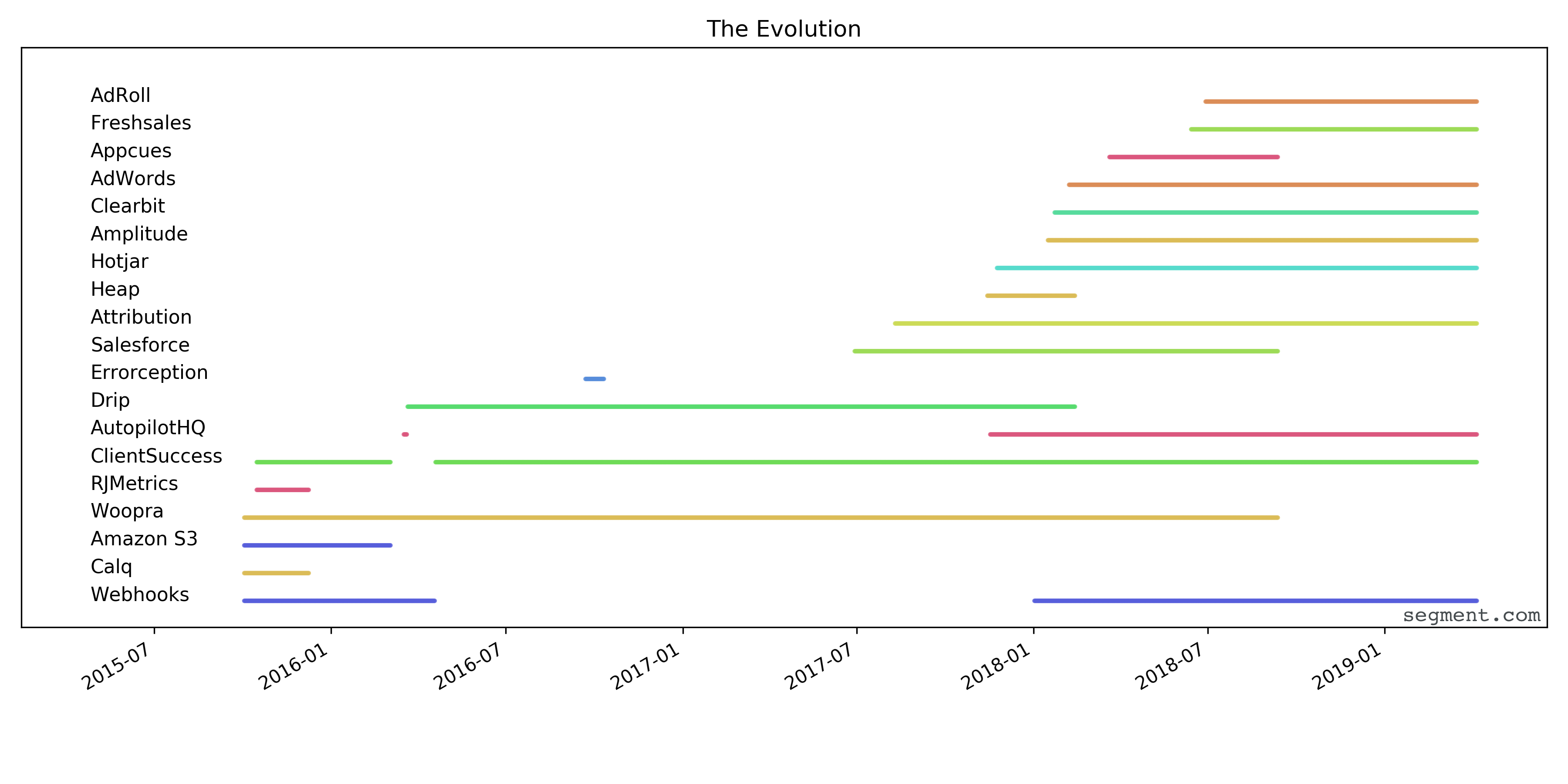

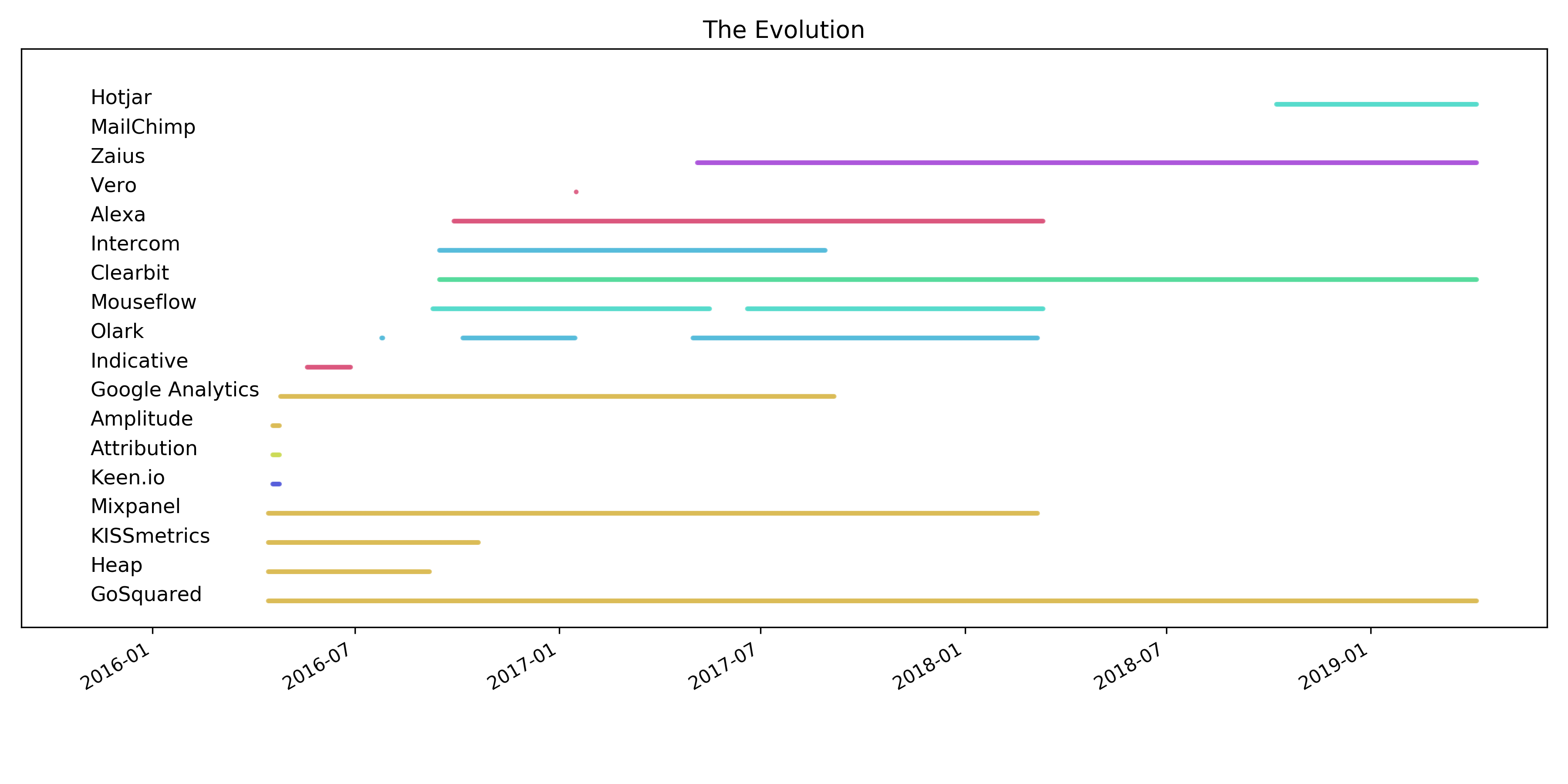

5. The Evolution

What it is: In some cases, a company’s entire data stack will evolve. There is almost no commonality between the tools they started with, and where they are at now. We find this happens especially often amongst our smallest customers.

What it looks like: Here’s the growth curve for a 50-person e-commerce company.

In this stack evolution, you can see that the user enabled nine tools in their first year of using Segment. Today, only three of them still remain in use (Woopra, ClientSuccess, and AutopilotHQ).

Instead, they have switched out their entire stack by adding in another seven destinations.

Here’s another stark example, this time from a small telco.

The user started by doing a bake-off of popular analytics tools. Over the course of their evolution as a company, they’ve used 18 different tools. Today, they only use 4, and three of those are totally different than the starting set.

Across our user base, we see more and more accounts that use a completely different stack than they started with.

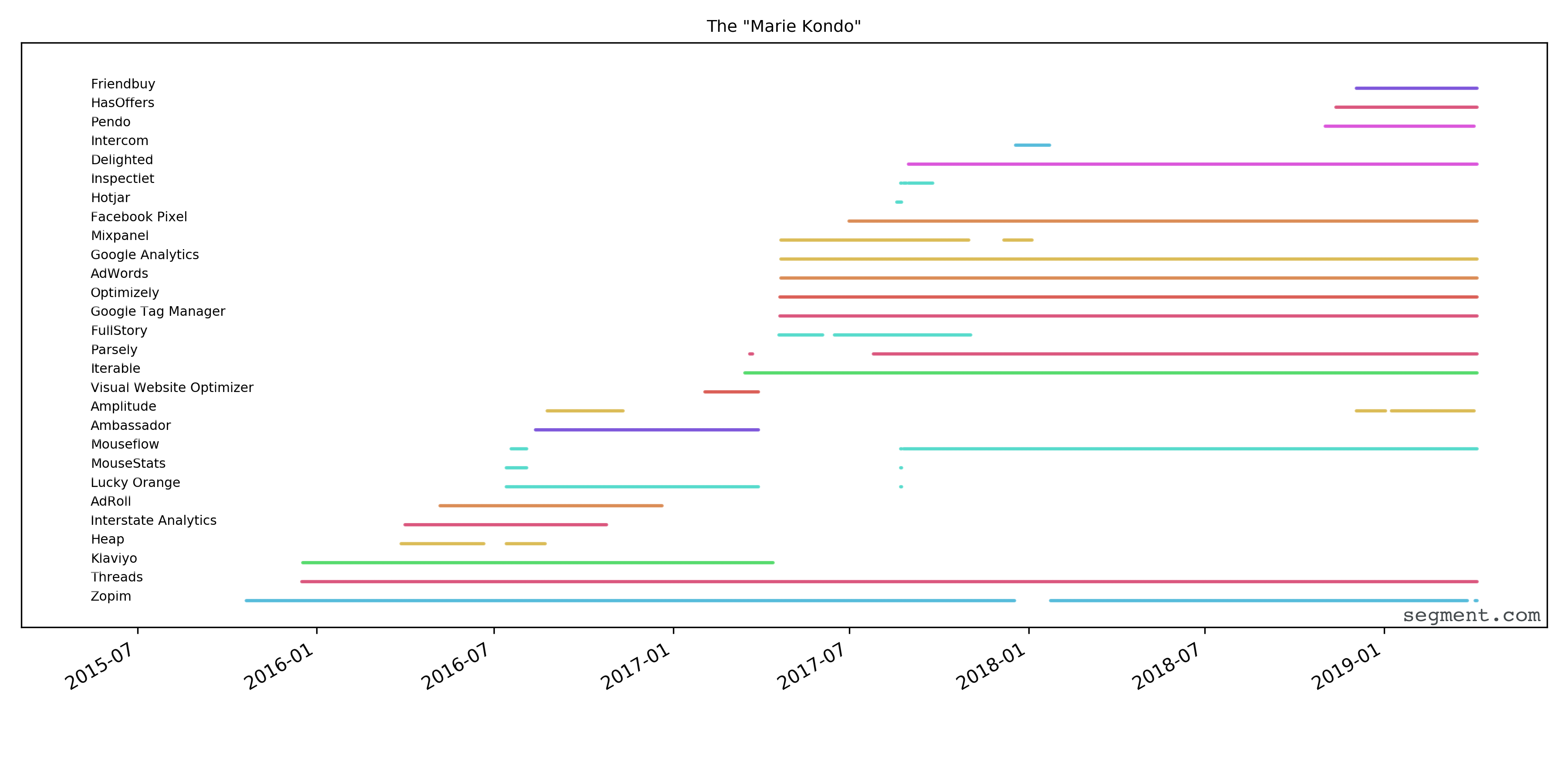

6. The “Marie Kondo”

What it is: In a handful of cases, we’ve seen areas where users wholesale swap their existing stack at a single point in time. Typically this is spurred by a new hire coming in, deciding that the existing tools aren’t working, and swapping them all out.

What it looks like: The following graph comes from a quickly growing insurance startup of ~150 people.

Here, you can see that in May 2017, almost all of the existing tools were replaced in favor of a different stack.

While this isn’t the most common use case, the “Marie Kondo” uses Segment as a nice insurance policy. Instead of being locked in to a single vendor for years on end, users have the freedom to switch as their business (and maybe their preference) changes.

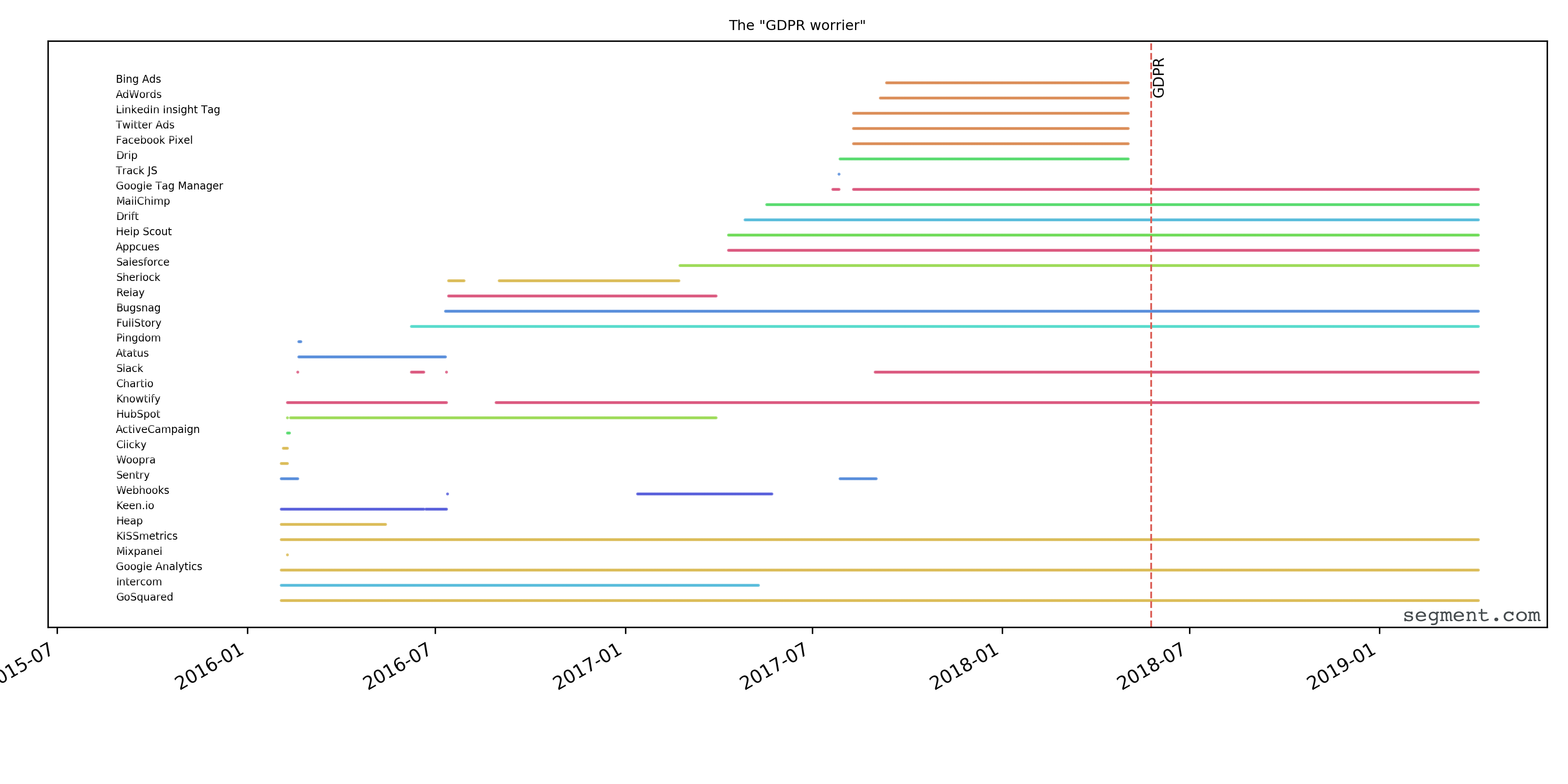

7. The GDPR Worrier

What it is: Regulations are powerful business drivers. Last May, the new privacy regulation in Europe known as the GDPR (General Data Privacy Regulation) went into effect. It specified that companies had to give their users the right not only to request their data, but to be ‘forgotten’ and purged from tracking systems (and that includes their analytics tools).

If you think back to a year ago, this was the time that you probably received a bunch of terms of service updates. Companies were in a mad scramble to make themselves GDPR compliant, and that included the tools they were using.

What it looks like: Here, we’ve included graphs which seem to be highly correlated with the May 25th date that the GDPR went into effect (the dashed vertical line).

In the month leading up to May 25, 2018, we see a significant number of users who instantly disable various tools that they might be using. These seem to be predominantly advertising tools + pixels, but there are a handful of other cases which seem to have users worried.

Fortunately, Segment helps our users cover this out of the box. We’ve built GDPR deletions in as a core feature of Segment, in addition to giving you the power to disable a tool with the flick of a switch.

We felt good about having aligned ourselves with privacy-first efforts, but it was interesting to see the market agrees with our decision.

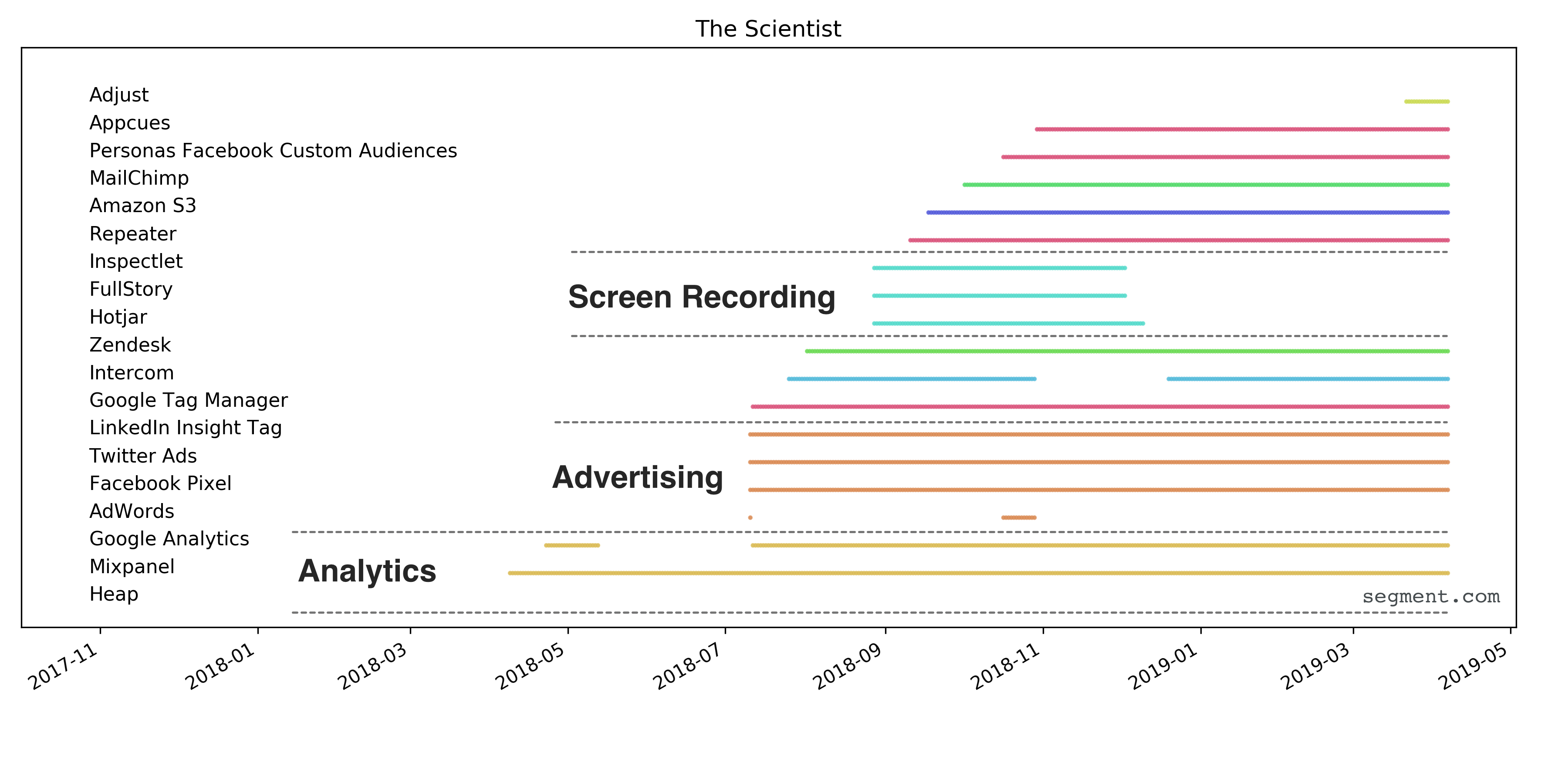

8. The Scientist

What it is: Sometimes companies are interested in trying out a new category tool to meet their use case, but aren’t sure which one they should pick. So they decide to keep a lot of similar tools running concurrently to solve best-in-breed use cases instead of relying on one tool for everything. It’s sort of like the bake-off, but systematically moving into new categories of tools.

What it looks like:

Despite being relatively small (< 10 people, satellite imagery company), this company is able to punch above its weight class by being focused and thoughtful when it comes to adopting new tools.

You can see here by the groupings of colors that this workspace moves from primarily an analytics use case to picking a set of advertising tools, and then further still to screen recording and heatmaps.

The scientists systematically expand into new categories (the color-coded piece here) as they get more advanced and their business evolves.

We see this sort of category adoption happening most often with advertising tools. Typically a marketing or growth hire will come onboard, and want to test out many different ad platforms to see which performs best. With Segment, they can do this in about 10-minutes, and wait for the results.

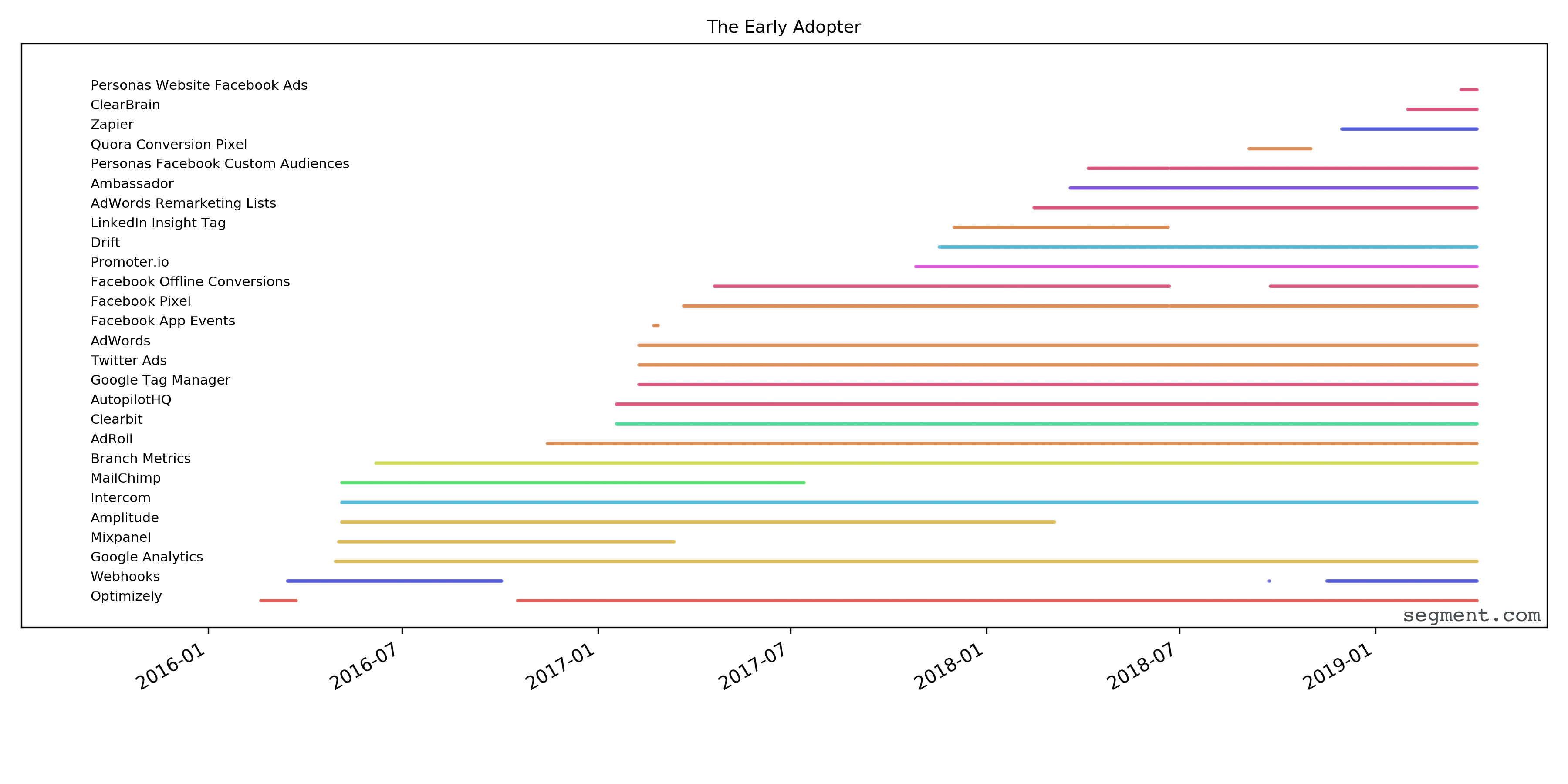

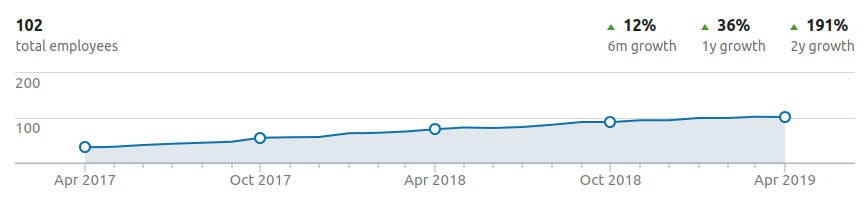

9. The Early Adopters

What it is: We’re constantly adding integrations through our newly launched Developer Center (we’ve added ~34 in the past 6 weeks), and we wanted to understand if companies on the ‘cutting edge’ of trying new data stack had anything in common. We found they are willing to use a lot of tools to solve their problems.

What it looks like: Here, you can find the curves for two of our users who were some of the first to enable ClearBrain, one of the new integrations made possible via our new Developer Center. The first is a B2B SaaS company of around ~100 employees. They show a consistent growth in terms of toolkit over the past three years.

The second also added ClearBrain just after it was announced. This company is much larger, with just over 1,000 employees. They’ve had a similar growth trajectory over a three year period, adding an impressive 29 destinations for their customer data.

The thing that struck us about each of these two graphs is how similar they look. Even though one of these companies is 10x bigger than the other, with thousands of employees, both of these graphs show a steady adoption in toolkits.

It’s hard to separate in this example what is correlation and what is causation. It seems intuitive that a fast growing company would more readily adopt new tools. There’s another angle that these companies actually grew more quickly because they were able to experiment and iterate rapidly.

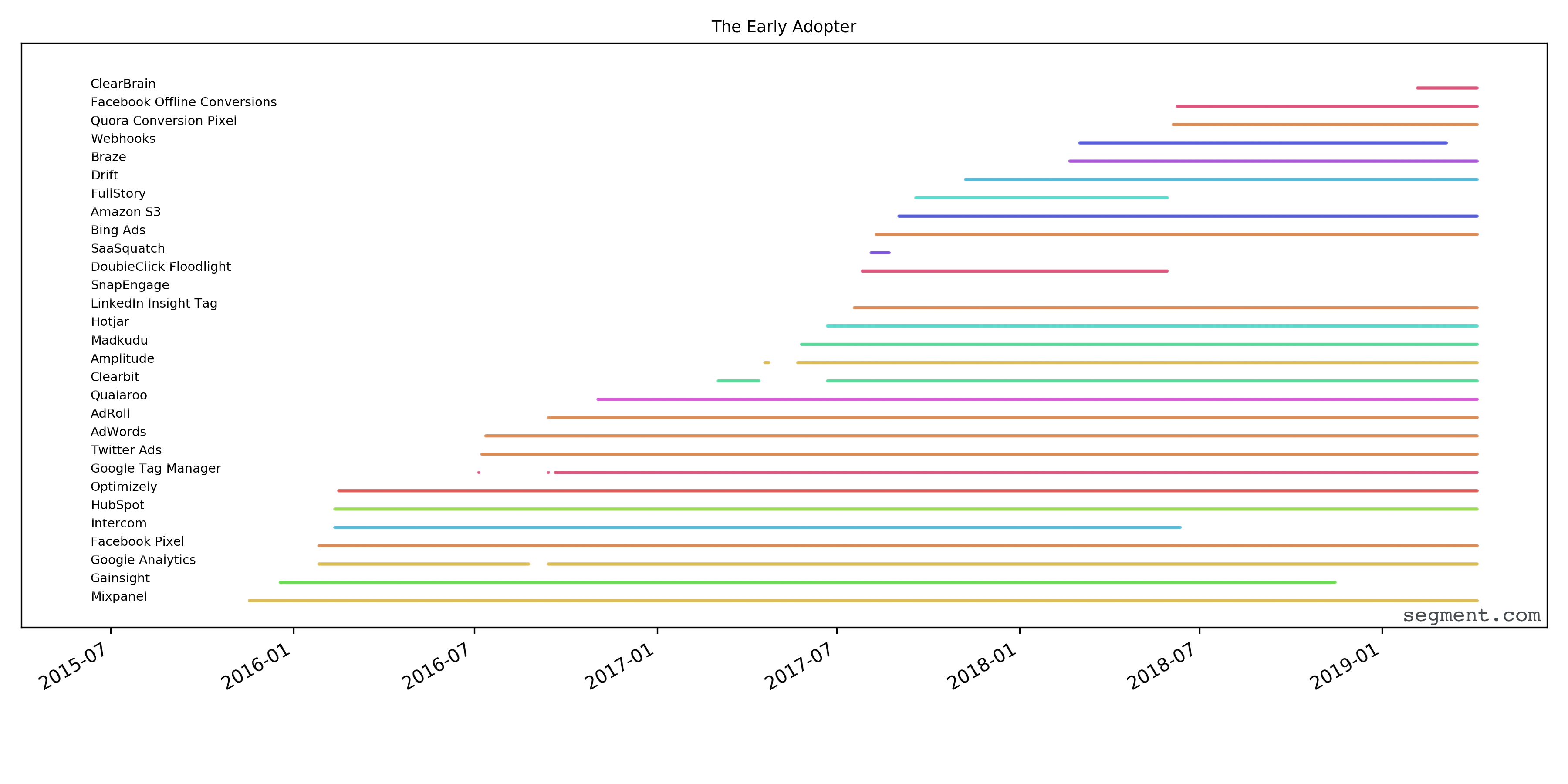

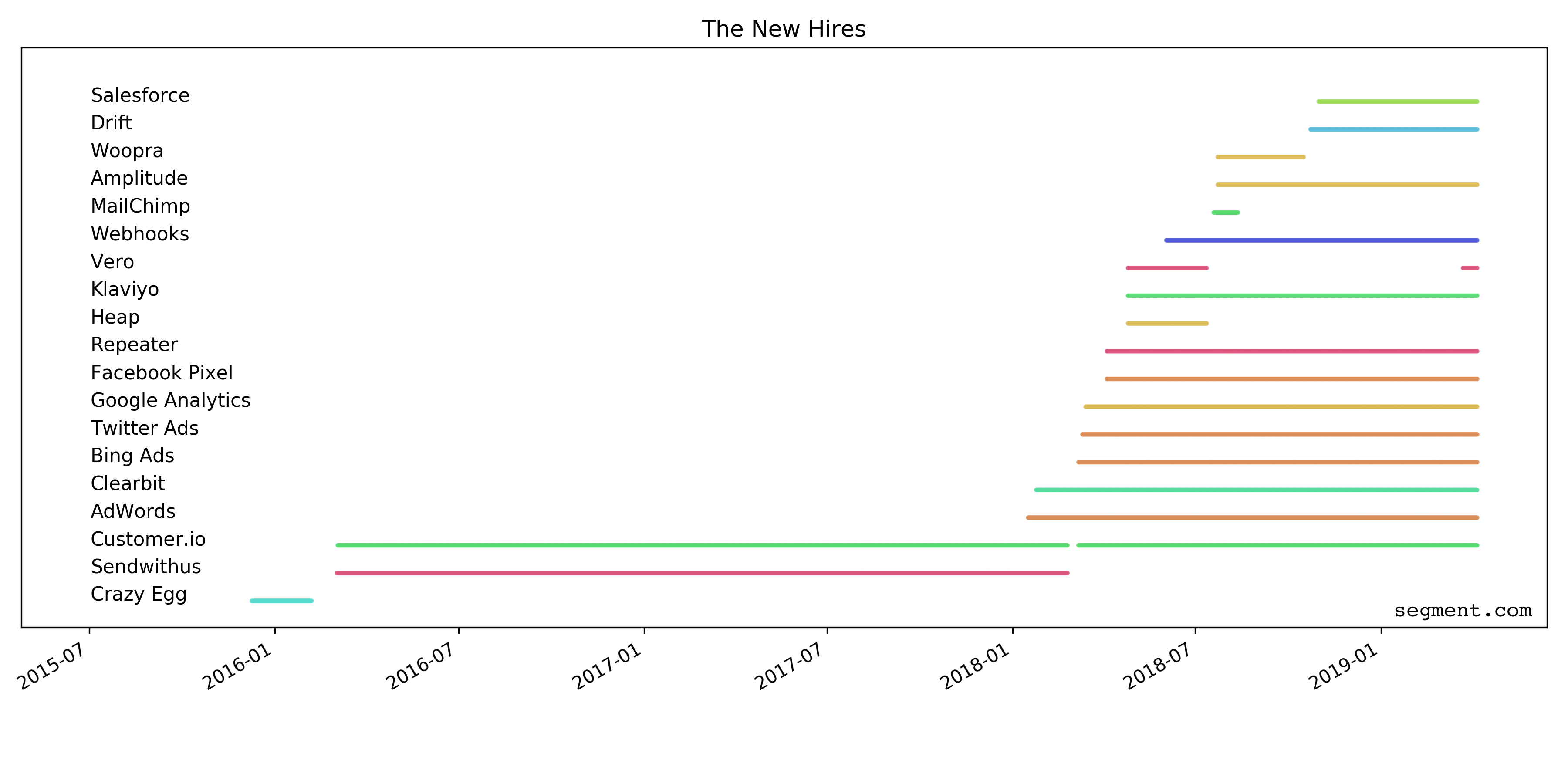

10. The New Hire

What it is: It is often the case that new tool adoption is hire driven. In some cases, it is very clear that the company is getting very serious about a particular use case and likely has hired someone to manage it.

What it looks like: We see a lot of curves that end up looking something like this:

This Segment user was relatively stagnant in their integration usage for years. They were happy with their stack of Sendwithus and Customer.io.

But in 2018, those needs shifted. We suspect that a new hire came onboard, specifically tasked with driving more growth for the business. When that happened, they immediately started leveraging a whole host of other tools.

Choosing your own buying strategy

Only you can determine what the right toolkit looks like for your business. However here are a few takeaways that you can use the next time you’re evaluating the next switch or turning on the latest tool.

1) The lower the cost to evaluate a vendor, the more switching happens

This is sort of the whole thesis for Segment in the first place, but it’s cool to see it actually play out in the data. As the cost to try new tools drops to zero, users do it more and more. It’s never been easier to evaluate a new vendor to understand how it works with your data, and not some pre-populated demo data. We see users evaluating vendors three to five at a time, and picking their favorite.

2) The stacks you use today are not the stacks of tomorrow

Of the graphs we shared here, on average these companies have tried out 21.2 tools over the course of their lifetime, but are using 12.2 of those today. Though they might come in with an initial use case and toolkit, those change over a multi-year time period as the company grows and the market shifts. The signal here is clear: if you’re buying from a vendor, target the 1-2 year time horizon, but don’t necessarily expect it to last more than 18 months. Get help choosing durable tools for your stack here 👉

3) As your business grows, you want new types of tools

Different types of tools have different target audiences. Some are good for finding the initial product-market fit (analytics and live chat), while others target companies who are looking to scale their growth (advertising).

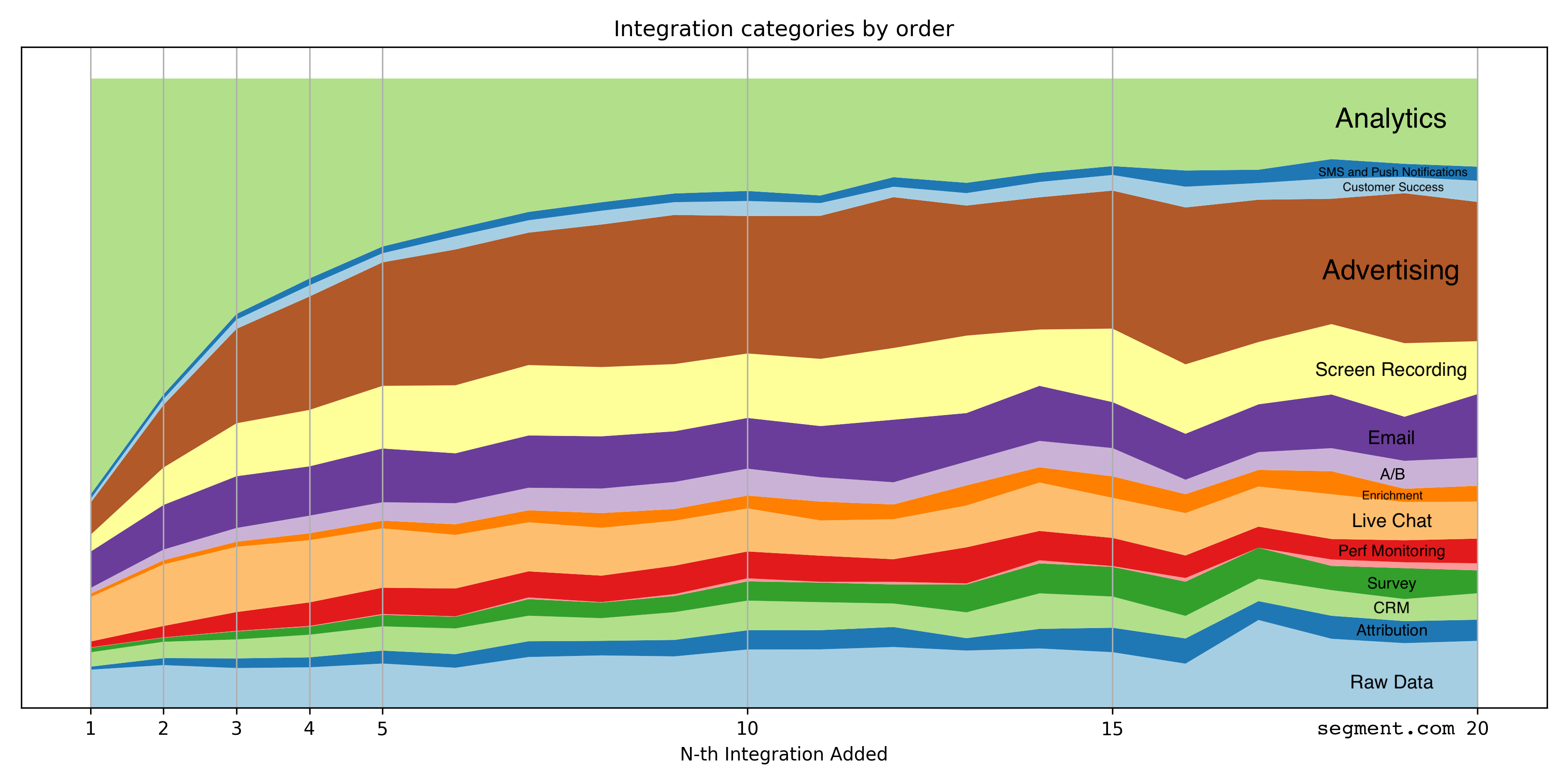

The following chart gives you an idea of how our customers add these tools over time. Across all of our users, we looked at the breakdown for which categories of integrations they were adding to their workspace as the first, second, and third integrations.

You can see here that most (over 60% of customers) start with an analytics use case. From there, they then expand to email, screen recording, and live chat tools, and then to more specialized use cases like advertising and raw data (which tend to be the majority after the 10-15th integration added). The Scientists are particularly good at evaluating one category at a time, and then picking the best tools for their business.

4) New regulations force new behaviors

We see a surprisingly large impact of regulation in terms of the tools our users adopt. Today, it’s GDPR. But there’s also CCPA looming on the horizon. As governments become more and more privacy conscious, we expect the value companies to get from data control to go up dramatically. Critically, it’s worth evaluating any of these vendors to see how they will support new regulations.

5) High growth companies tend to be early adopters

The most avid adopters of new tools tend to be the ones who are growing most actively. They are able to constantly experiment with new avenues for growth, and at the same time outsource anything non-core to various SaaS offerings.

This is the biggest reason new partners are building on Segment today. High growth startups are constantly looking to get an edge on their competition, and using the best-in-class new tools is one of the best ways to do that.

Get recommendations for building out your stack

We've helped thousands of companies of all sizes build durable tech stacks and we're here to help you too! Get started here 👉

The State of Personalization 2023

Our annual look at how attitudes, preferences, and experiences with personalization have evolved over the past year.