Source: Exponea

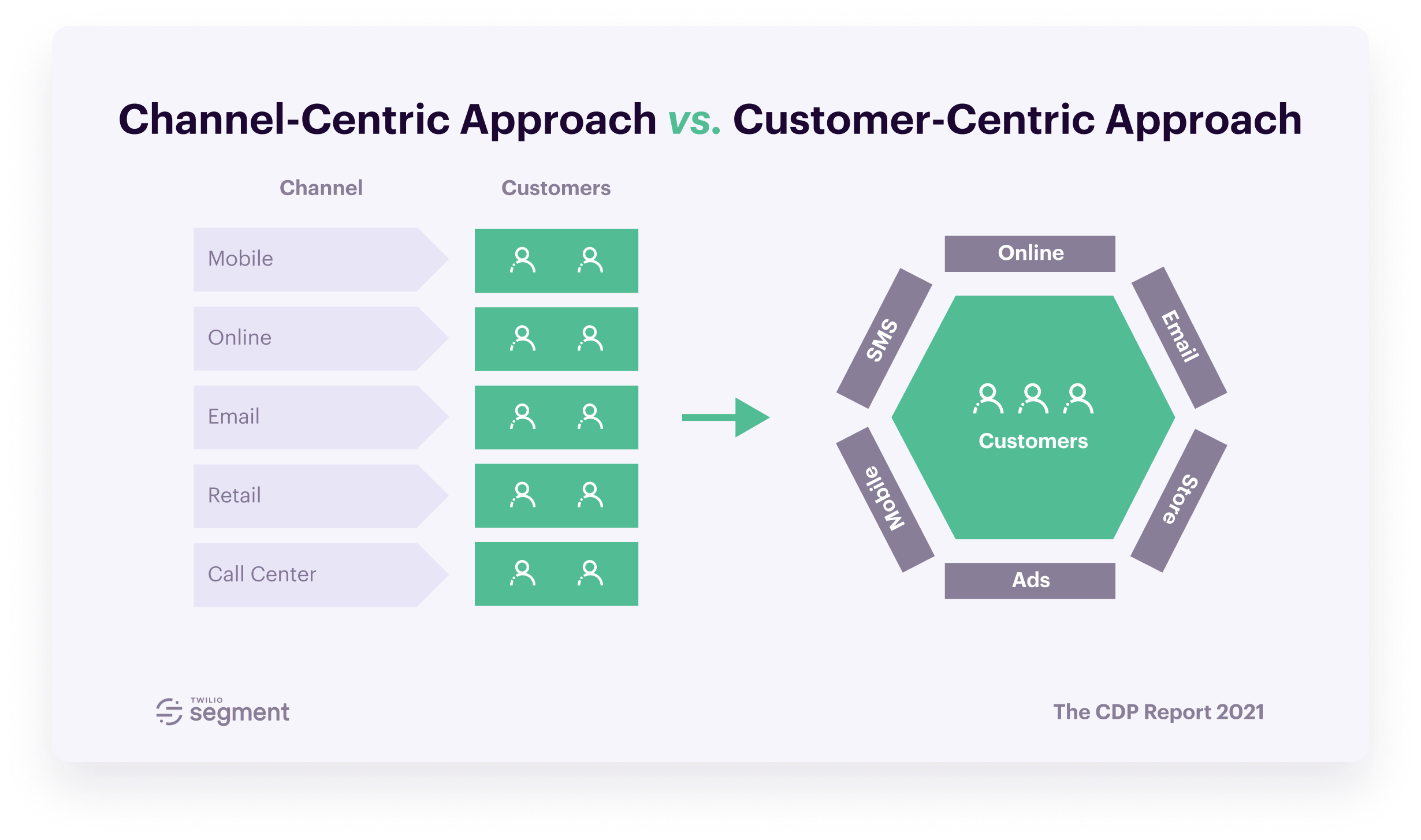

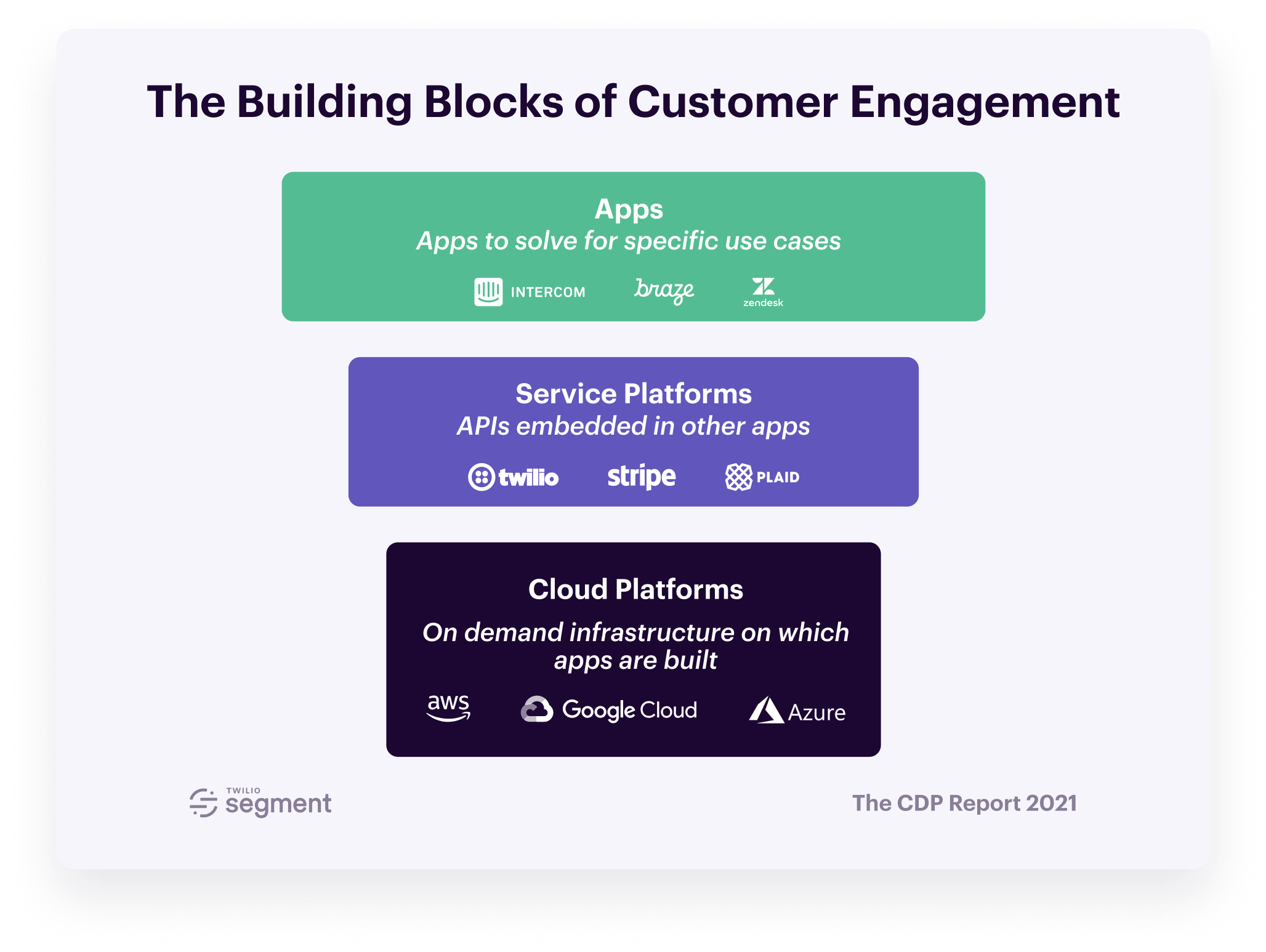

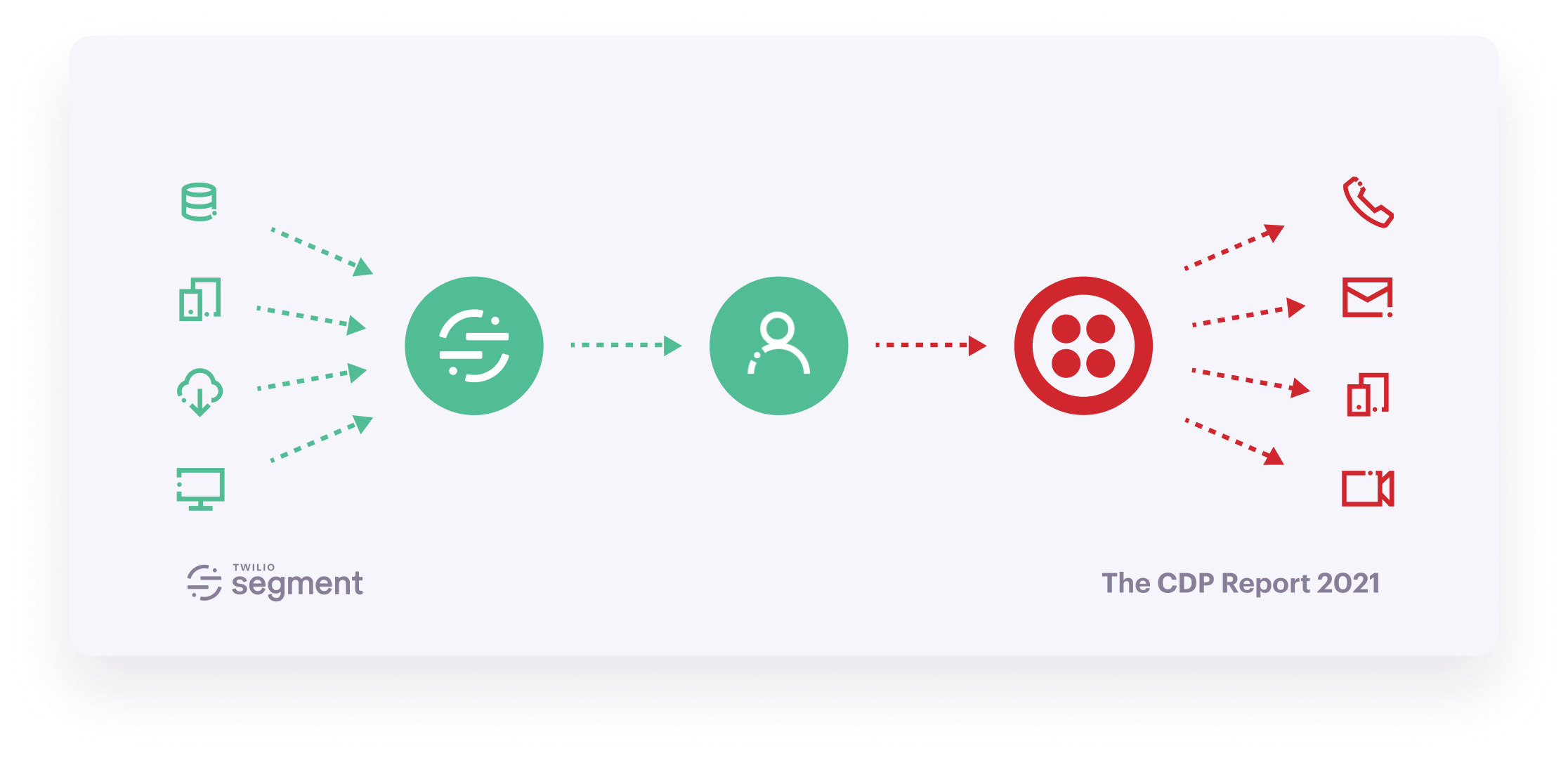

Businesses could easily reference and utilize data generated in entirely different functions within their organization. And customers could benefit from intelligent and informed communication, irrespective of the channel.

As the #1 CDP, according to the IDC, and holding more than double the market share of the second-ranked CDP, Segment is in a unique position. By analyzing our internal data, we can generate a high-level overview of how CDP usage is evolving.

Before we dive in, it’s important to understand how we analyzed and interpreted the data.

-

The data is pulled from a snapshot of data from 1/1/2020 to 12/31/2020.

-

The data is sourced from the internal usage behavior of Segment’s 20,000+ customers.

-

We have only included tools that have active integrations in the Segment catalog as of 12/31/2020.

-

Categories are based on whether or not they are in the Segment catalog with that category tag.

-

The data is based on the number of customers using each destination/source, rather than the number of workspaces. In some cases, a customer may have multiple Segment workspaces.

Now that we’ve established some ground rules, let’s dive into the data.

What sources are companies collecting data from?

As we saw earlier, the potential of a customer data platform is that it lets you collect and unify all of your customer touchpoints, not just what’s happening on one channel.

Our data bears this out.

Customers aren’t just clicking around on your website or app. They’re chatting with support teams via live chat, talking with your sales team via email, clicking on your Facebook ads, and much more. Companies are bringing a wide variety of data into customer data platforms to get a complete picture of customer interactions.

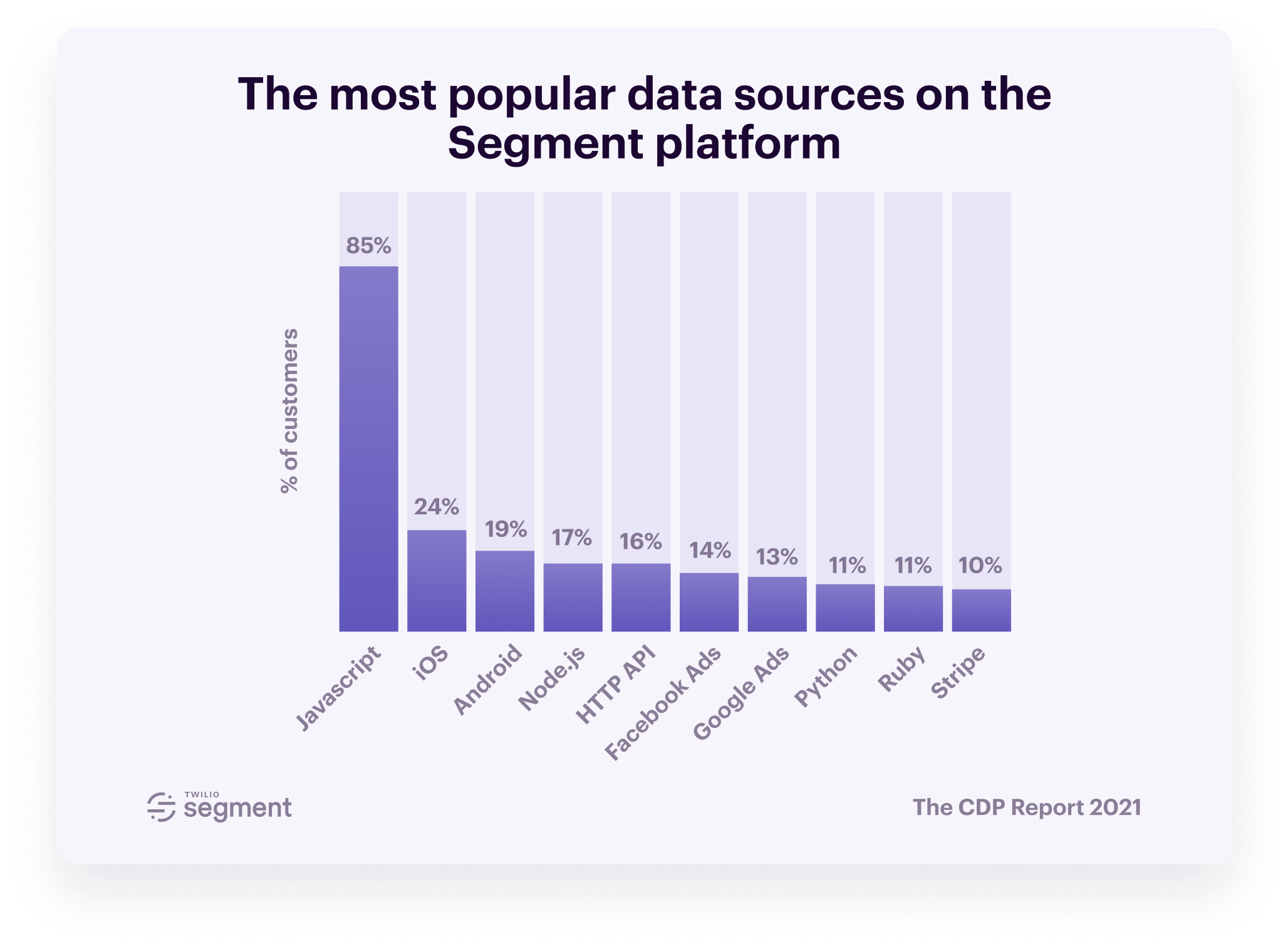

If we examine the data sources connected to Segment’s customer data platform, we see four main types of sources: Web (JavaScript), Mobile (iOS, Android), Server (HTTP API, Node.js, etc.), and Cloud (e.g., Stripe, Sendgrid, etc). This breadth of data sources proves in a visceral way how the customer journey is happening across multiple channels.

Last year, Javascript came out on top as the number data source on the Segment platform, and it shouldn’t come as much of a surprise that it has come out on top once more.