The Growth Report 2023: AI edition

Brought to you by Twilio Segment

Jump to section

Introduction

More than meets the AI

Twilio Segment’s third annual Growth Report is a yearly exploration of the tools, technology, and techniques businesses are using to grow in 2023. This year, It should surprise no one that one trend came through in our survey loud and clear – the rise of AI.

We saw an unprecedented level of AI adoption, and real business impact being achieved. Additionally, as AI becomes more deeply rooted within organizations, more advanced strategies are being leveraged to maximize its potential.

In this year’s Growth Report, we surveyed 2,450 marketing, CX, and data leaders from across industries to explore what it means to grow sustainably in 2023, and how companies are using AI to do just that.

Key Findings

AI is officially everywhere

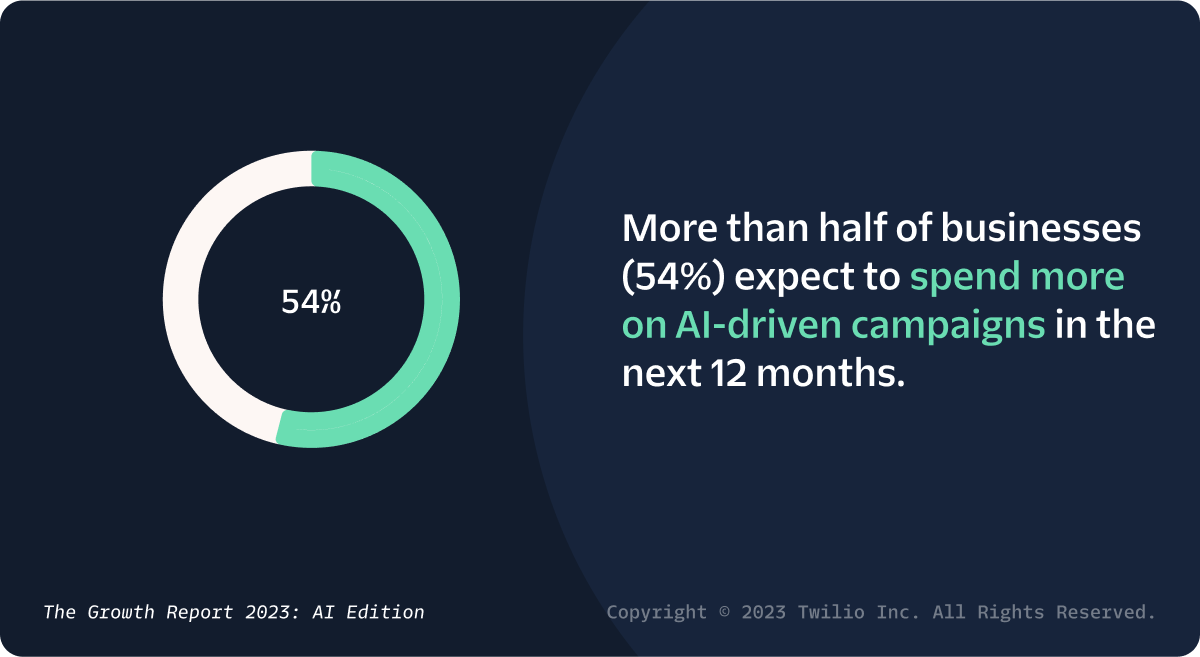

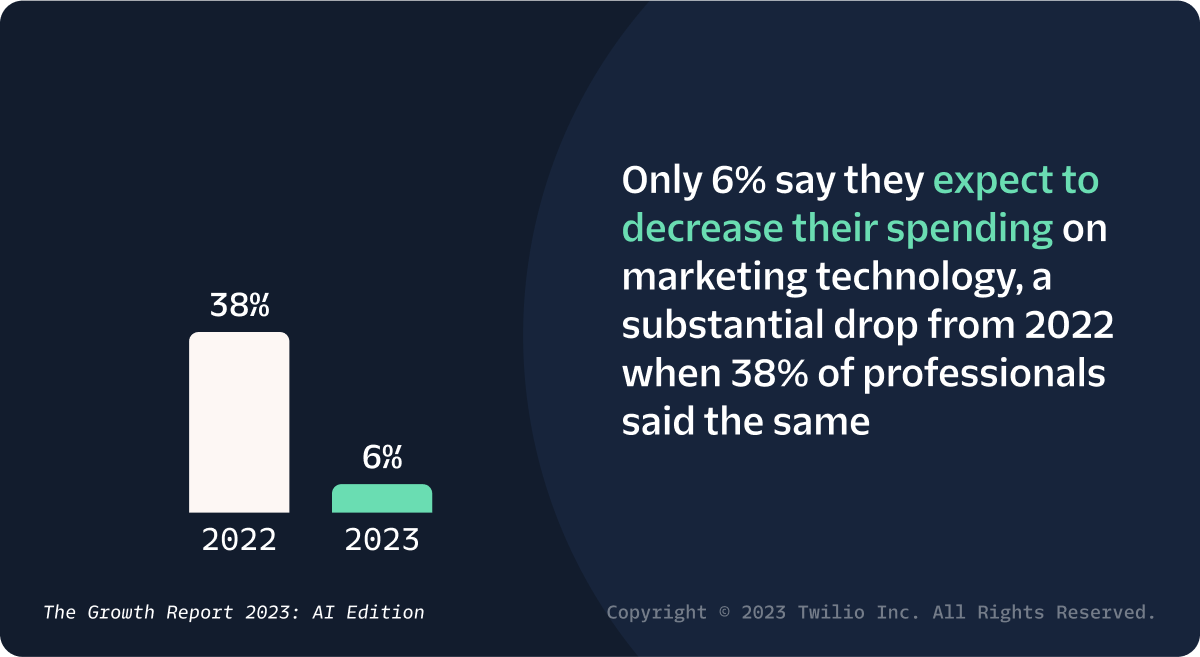

Despite the uncertain economic landscape, there’s still an appetite to try new things, especially if those new things (ahem, AI) have proven results. Some examples of what businesses are spending money on? Efficiency. Personalization. Scalability.

When it comes to tech that delivers results across a variety of use cases, AI seems to fit the bill. And businesses are budgeting for it.

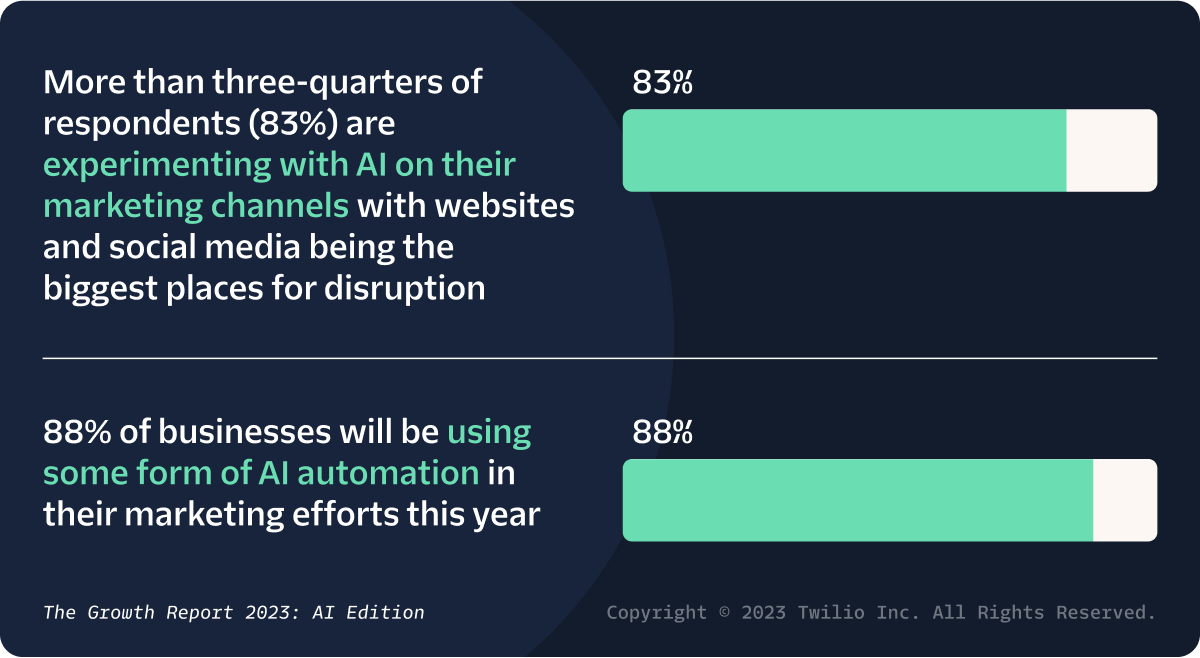

AI is changing the marketing game, specifically with chatbots and personalized product recommendations

You get a chatbot! You get a chatbot! Oprah memes aside, businesses are betting big on how to use AI in channels that are already providing the most ROI for their customers.

For both website and social, this means personalization driven by thousands of unique customer journeys that AI can build in mere seconds – enhancing copy, segmentations, and A/B testing faster than ever before.

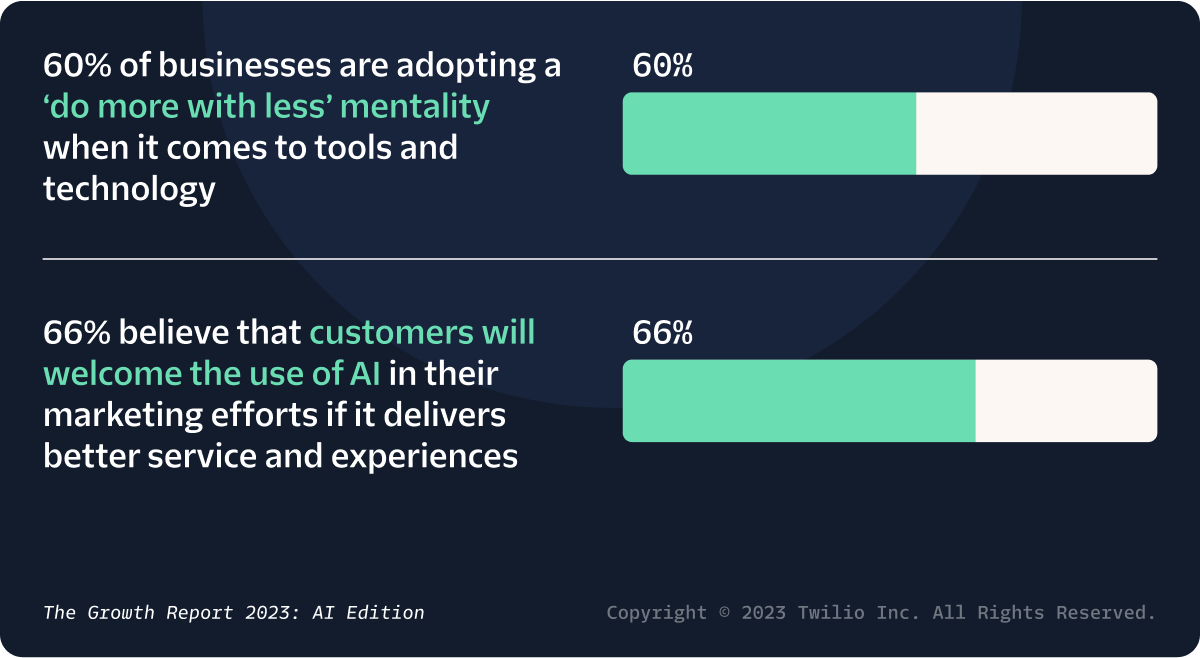

Do more with less: AI means more time and more money

The trend of businesses amplifying their investment in AI signifies more than just a passing inclination.

While 46% of businesses think AI is delivering time savings for their business, they're also betting on it delivering real ROI as well. 37% also believe integrating AI into their marketing campaigns could be the catalyst for tangible financial savings.

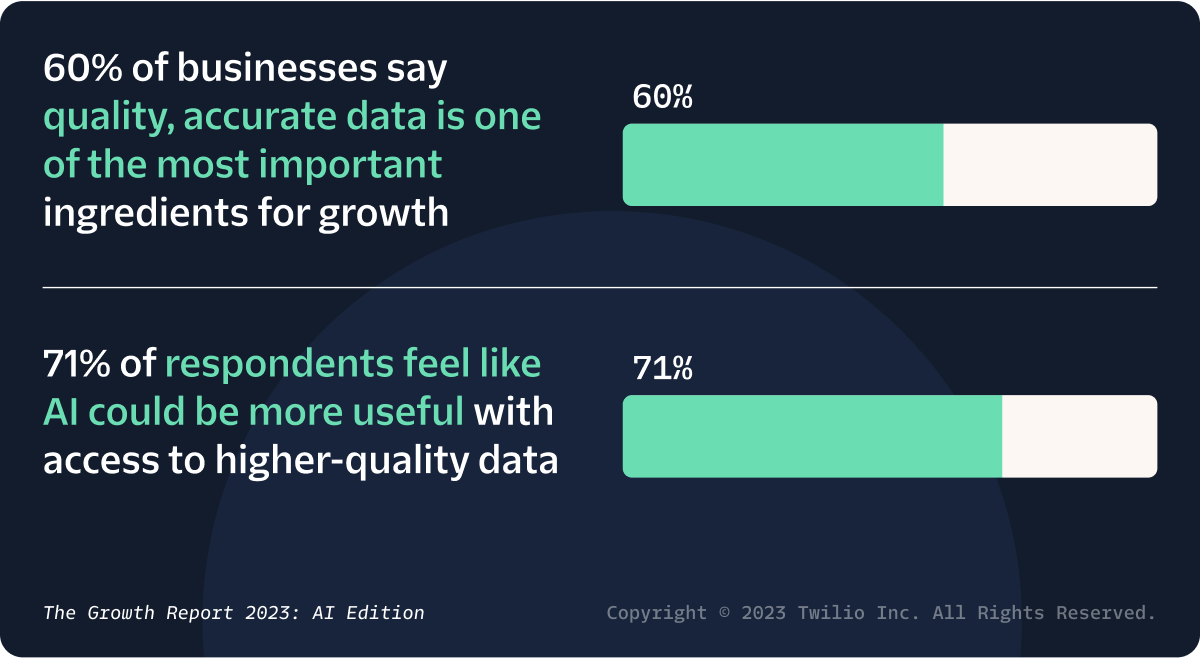

The key to unlocking AI? Quality data

The transformative impact of AI on the business landscape is undeniable. However, the true potential of AI in driving growth hinges on the quality of the data it processes.

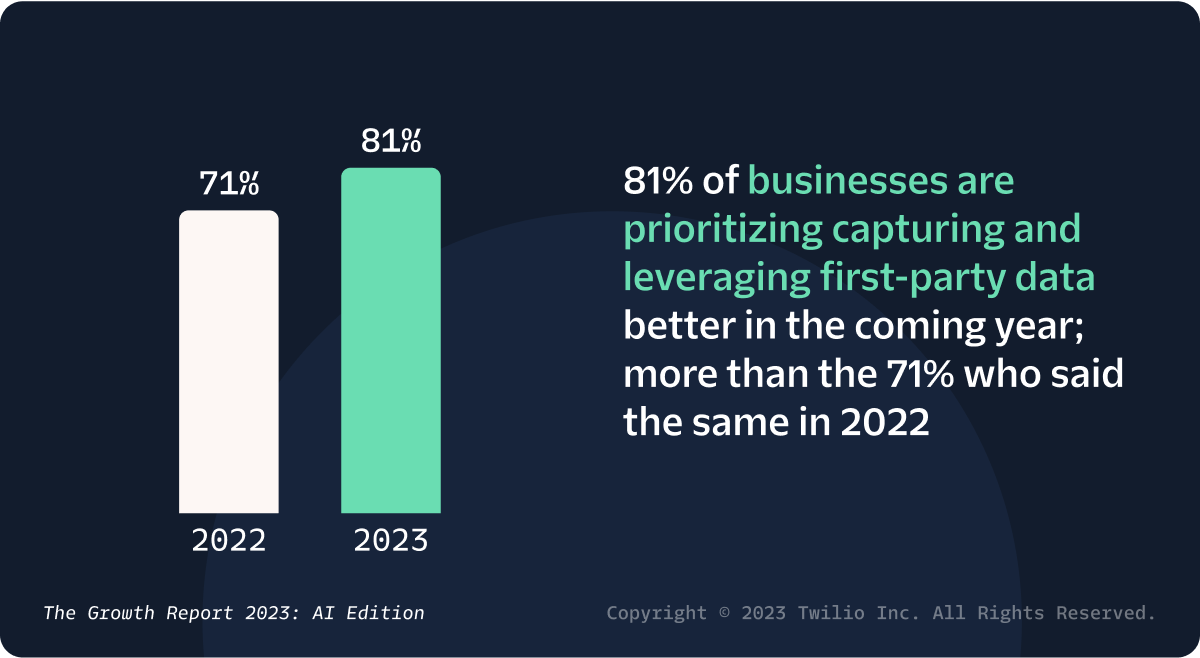

Given how many businesses are prioritizing first-party data in the coming year, it goes without saying that businesses will continue to need to do so as they also integrate AI efforts.

Our Take

Data drives the ‘AI’-lgorithm of success

In the complicated dance of business growth in 2023, it’s clear that AI is setting the rhythm but data will always choose the tune. Without rich, quality data to guide it, even the most sophisticated AI remains directionless.

As businesses continue to look for new (and sustainable) ways to find growth opportunities, making sure they have access to the best information to inform their campaigns (in whatever capacity) will be integral to that success.

Curious about how to get started in corralling, analyzing, and segmenting your own customer data to enhance your AI strategy while delivering better customer experiences?

A Customer Data Platform can help you with that.

Sign up for a free trial today, or chat with a member of our team to find out what a CDP can deliver for your business.

Methodology

- Twilio Segment conducted this research using an online survey prepared by Method Research and distributed by Cint among n=2,450 full-time employees familiar with the company’s growth strategy working in marketing, engineering, UX, product, and customer services roles at B2B companies with 75+ employees.

- The sample consisted of n=1,000 respondents from the United States, n=300 from each of the United Kingdom, Brazil, Germany, and France; and n=250 from Australia. Data was collected from August 3 to August 30, 2023.

Disclaimer: This report contains statistical data, estimates, and expectations that are based on publicly available information, as well as other information based on our internal sources or collected through our commercial relationships. These do not represent, and should not be construed as indicators of Twilio’s historical or future financial performance or the actual or potential demand for Twilio's products and solutions, and such information is solely presented as context for broader market trends.