The CDP Report 2022

By Twilio Segment

You’re all set!

Check your inbox for an email confirmation with a link to the report. You can also click the link below to access now.

Welcome to the third annual Customer Data Platform report, an in-depth look into how customer data is powering our daily lives.

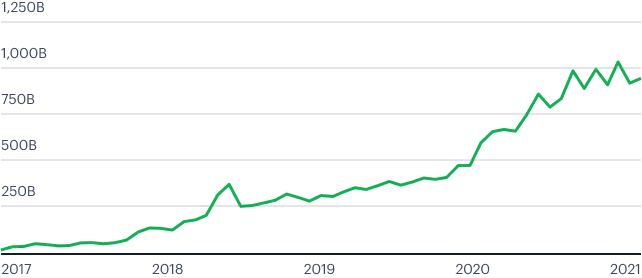

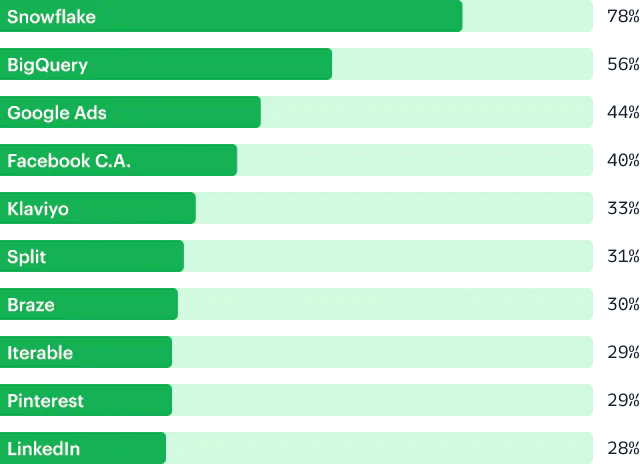

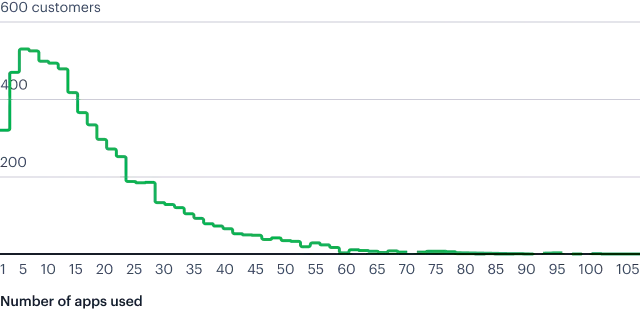

By examining over 10 trillion API calls from the Segment platform, we'll share the major consumer and business trends we've observed over the past 12 months.

Download the full report or continue reading our key findings below.